Every year I gather insights from supply chain professionals around the globe regarding their priorities, challenges, and anticipated changes for the upcoming year. Just this week I heard a supply chain professional say, “All of our fun has just begun.” Although we finally finished 2020, we are not back on stable footing for our supply chains, and many of the challenges ahead reflect that chaos.

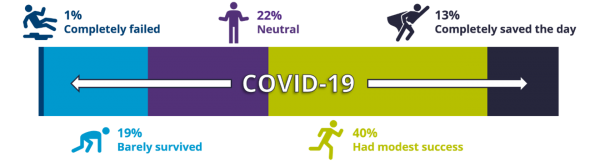

APQC concluded its seventh annual global Supply Chain Management Priorities and Challenges research in early 2021 with insights from 455 organizations across 12+ industries around the world. Let’s start with some insights into how supply chain professionals rated their 2020 supply chains’ performance when it comes to responding to COVID-19 (Figure 1).

It is worrisome to note that 1 in 5 supply chains barely survived the COVID-19 crisis. It’s vital that these organizations use the lessons learned from 2020 to proactively prepare for the next disruption (since the question is when not if there will be some future supply disruption). Check out this article, What Supply Chain Leaders Need to Know for 2021, for some advice.

I would like to acknowledge the 13 percent of supply chains that completely saved the day in the face of COVID-19. It took many people in those organizations going above and beyond the “normal” to make that happen. In talking to these organizations, I have heard about greater cross-functional collaboration, more frequent re-planning, deeper relationships with suppliers, and faster decision-making. (See Supply Chain Planning: Blueprint for Success for additional insights.) Also, it speaks to the pervasive nature of this crisis that only 5 percent of 455 respondents said their supply chains were not significantly impacted by COVID-19 (not displayed in Figure 1).

Now let’s look at top trends and obstacles facing supply chains.

TOP 3 TRENDS ANTICIPATED TO IMPACT SUPPLY CHAINS

In the next three years, many different trends and changes will impact supply chains. In addition to digitization of the supply chain, here are the top three trends identified (by percentage of respondents rating it as a major or moderate impact).

» 34% Robotic process automation (RPA) which will help improve productivity and efficiency by enabling people to spend time on more value-added activities vs transactional ones.

» 32% An automation shift will enable more time spent on the second trend: a greater focus on environmental, social, and corporate governance (ESG) factors and issues.

» 32% Blockchain, the third anticipated trend, can enable greater traceability and visibility, also enabling sustainability efforts.

Respondents also expect that cloud computing will have a major impact on supply chains by enabling access to data at anytime from anywhere.

Robotic Process Automation is Adding Value

In our research, I have seen that RPA is not a plug-and-play tool and must be set up with care. With a thorough understanding of how end-to-end processes work, organizations need to select appropriate processes or activities for automation using standardized criteria. Evolving, emerging, or immature processes— and those with large ratios of exception management—are not good candidates for automation. More broadly, sophisticated RPA applications require ongoing adjustment, and some roles may need to be restructured in order to fully realize productivity gains from RPA.

Digging into Robotic Process Automation for Procurement, for example, one interesting thing I see is that more is not always better. There is a point of diminishing gains and even productivity losses depending on the number of bots that procurement is using. It makes sense that a procurement team would add additional bots as it grows its RPA capabilities. Yet we find that gains from RPA begin to reverse for organizations with more than 20 bots in use in procurement. For example, organizations employing more than 20 bots have more FTEs ordering materials and services and process fewer purchase orders per FTE than those that use 6 to 20 bots.

It is likely that these organizations are seeing declining results because they are automating processes that are not actually good candidates for RPA. Some procurement and supply chain processes are highly strategic and require critical thinking and relationship building. For that reason, it is important to be intentional and selective about what you are automating. RPA might be a hammer when it comes to cutting costs and boosting efficiency, but not every process is a nail.

Environmental, Social, and Corporate Governance (ESG) Factors Increasing in Priority

Environmental factors, social issues, and governance (ESG) commitments and goals is a broad umbrella covering many things that are relevant to supply chains. I have been having conversations with organizations seeking lower carbon emissions from transportation and production, striving for ethical sourcing, and attempting to improve human rights throughout the end-to-end supply chain. In some cases, this umbrella is being extended to include diversity, equity, and inclusion issues in suppliers as well.

Given the increasing focus and potent impact on supply chains, this is a topic we will be covering with upcoming research. One thing we already see is that sustainable sourcing is key for next-generation procurement. APQC is seeking to synthesize the latest corporate practices in these topics: what is most commonly included under this umbrella, how is it defined, structured, and measured? I would like to hear from you with your organization’s success stories (and even failures – since it’s all a learning experience) about changes to your processes in this arena and if your organization is applying new technologies.

Blockchain Adoption is Growing

It’s interesting to see blockchain finally rising toward the top of the list of trends people expect to impact supply chain in the coming future. I’ve been tracking the awareness and adoption rate of this technology for the past several years, and adoption has definitely lagged the hype surrounding it.

In APQC’s 2020 poll, Blockchain Adoption in Supply Chain: Current State for 2020, we saw an increase in familiarity with the technology (80 percent up from 66 percent the prior year), and 48 percent of respondents saying their organization would probably or definitely invest in blockchain in the next two years (vs 23 percent in Blockchain in Supply Chain: 2019 Current State).

Blockchain refers to peer-to-peer distributed ledger technology that can record transactions between two parties efficiently and in a verifiable and permanent way, enabling tracking and traceability. The biggest obstacle to adoption (cited by 60 percent of respondents last year) has been the lack of adoption by other companies, which is not surprising, given the peer-to-peer nature of this technology. When the trust level with partners up and down the supply chain finally reaches the point where multiple organizations take the plunge together, we will see significant gains in the adoption rate of blockchain.

TOP 3 OBSTACLES TO IMPROVING SUPPLY CHAIN PROCESSES

Chaos has made improvement efforts difficult in supply chain; in fact, it’s the number one obstacle to improving processes. More than 40 percent of respondents report that when trying to improve their supply chain processes, they are facing too much change. There is also a lack of support for collaboration across functions as well as externally.

» 42% Too much change

» 40% Lack of support for internal and external collaboration

» 38% Limited workforce engagement /

Good news: nearly 7 out of 10 respondents (68 percent) report they have modified their supply chain strategy to help head off current challenges. Flexibility in the face of challenges will be vital to thriving during chaos.

Learn More

To hear more about the results of APQC's research into 2021 supply chain concerns, please register for the February 25 webinar: 2021 Supply Chain Priorities and Challenges.

Coming soon: APQC will publish the full results of our 2021 Supply Chain Priorities and Challenges research, plus 12 industry reports, and a comprehensive white paper.

To continue the conversation, comment below, follow Marisa on Twitter at @MB_APQC, or connect with her on LinkedIn.