Order-to-Cash (O2C) is a critical end-to-end process that, when optimized, creates a seamless value chain from customers to the business. But for many organizations, O2C has been a particularly gnarly set of processes to optimize. Its domain stretches across functions and organizational boundaries and involves customer interactions.

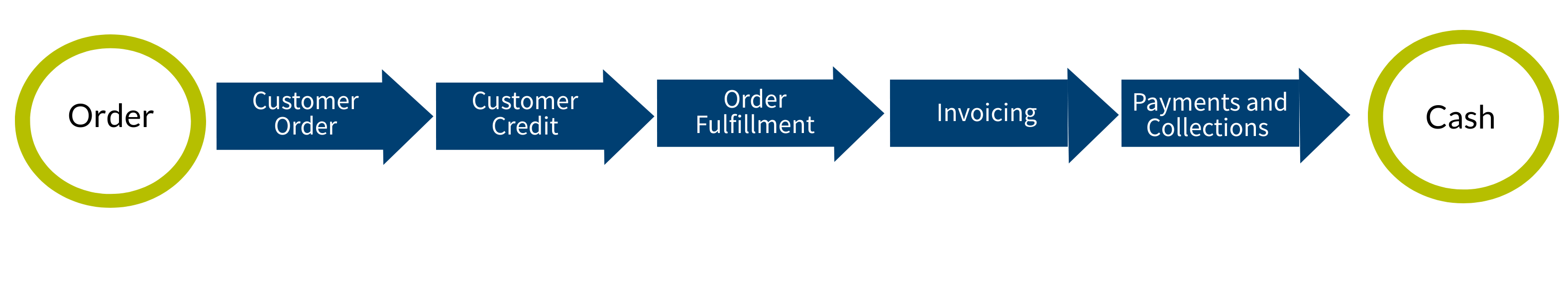

The end-to-end O2C process, as APQC defines it, is a set of business processes that involve receiving and fulfilling customer requests for goods and services and getting paid for them. That is, the process includes all the steps an organization will carry out from the time it receives an order to the point the organization receives payment for the order. Its component processes include: the customer order, customer credit, order fulfillment, invoicing, and payments and collections.

O2C RESEARCH

APQC is keeping an eye on the continuously evolving O2C arena. We have a survey that is now open to gather insights into the current state of Order-to-Cash. You are invited to participate in this new survey by clicking here. All respondents will receive a summary report of the results.

Additionally, I recently completed a research project on optimizing Order-to-Cash, sponsored by Esker Inc., and it became apparent that organizations need help with process definition, design, governance, and measures. Here’s a link to the report and the on-demand webinar (and presentation slides) if you’d like to learn more about our research findings.

Process optimization is usually gauged through key performance indicators (KPIs). In the case of O2C, APQC has found that the top KPIs are end-to-end process cycle time, days sales outstanding (DSO), and on-time delivery performance. Although less popular, APQC would recommend also focusing on striving for perfect order performance; after all, a quick cycle time is not a win if a delivery is incorrect, damaged, or missing parts/paperwork.

THE NEED TO INTEGRATE ORDER AND CASH MANAGEMENT PROCESSES

Accurate and efficient order management is especially important to effective cash management. Managing incoming sales orders is a highly critical element in the revenue accounting cycle. And professionals managing an organization’s cash need a means to access and review order information to address outstanding invoices and other information transfer breakdowns. All too often, customers make payments that fail to successfully match outstanding receivables. For this reason, the end-to-end O2C process benefits from order management and AR using integrated systems.

APQC has found that organizations with high cross-functional process efficiency and effectiveness between the “order” and “cash” sides of O2C see greater success. The top three enabling factors are:

- Process governance for the overall O2C process

- Common or integrated systems between order and cash

- Common measures and goals between order and cash

Clearly, end-to-end integration requires a common focus and systems. Organizations with outdated, separate order management and cash management processes and systems lack visibility into the end-to-end O2C process for optimization. This means limited control over exceptions, errors, and information transfer breakdowns. A lack of integration also limits the extent that customer service, sales, and AR can collaborate on customer issues and support. Figure 5 details the biggest challenges when an O2C value stream lacks integration between order management and cash management processes; it’s apparent that the top challenges can be mitigated by systems integration and automation.

APQC has found that some organizations lack integration not because of separate systems but because of a lack of systems. Some organizations persist in manually processing customer orders, which contributes to higher processing costs and error rates, failed service level agreements, dissatisfied customers, and frustrated customer service teams. Ultimately, a manual approach leads to problems throughout the O2C value stream, including inaccurate invoices, missed key collections, disorganized and scattered post sales–related information, increased exception management, and subpar DSO results. A system that integrates order management and AR can eliminate disruptions from unique customer requirements, manual handoffs, input errors, and omnichannel variance.

KEY DRIVERS FOR AN EFFECTIVE END-TO-END ORDER-TO-CASH PROCESS

APQC has interviewed leading organizations about their best-practice O2C processes in terms of defining, governing, managing, improving, automating, and evaluating the end-to-end process. We also looked at results from our Open Standards Benchmarking database, the world’s largest collection of process measures and validated performance metrics, to pinpoint the best practices driving top performance in key O2C benchmarks. We found three key drivers for optimizing O2C processes:

- installing a global process owner

- leveraging mobile and cloud technology

- determining the right system support.

LOOKING FORWARD

Taking and processing customer orders, as well as invoicing and collection based on those orders, are central to an organization’s business. The order-to-cash process both establishes a customer’s perception of an organization and directly affects the organization’s bottom line. Although supply chain is only part of the process, supply chain professionals must recognize that their collaboration efforts are integral to the success of order-to-cash as an end-to-end process.

Creating an efficient and effective order-to-cash process also means standardizing processes and adopting systems that enable increased data access and visibility. A natural next step in this is automation, and best-practice organizations recognize that they benefit from automating as much of the order-to-cash processes as possible. Automation overall reduces the cost and time needed for order-to-cash and also lowers the cost of managing sales orders. It lowers operational costs and increases working capital. It also frees up employees so that they can engage in more value-added activities.

Optimizing the end-to-end order-to-cash process gives organizations a more strategic approach to their activities. By viewing the process as a valuable chain of interconnected activities, an organization can improve coordination among departments, improve performance, better communicate with customers, and increase customer satisfaction.

LEARN MORE

- Participate in the new survey

- Optimizing Order-to-Cash collection

- Optimizing Order-to-Cash report and executive summary

- Eliminating Silos to Drive Order-To-Cash Performance

To continue the conversation, comment below, follow me on Twitter at @MB_APQC, or connect on LinkedIn.